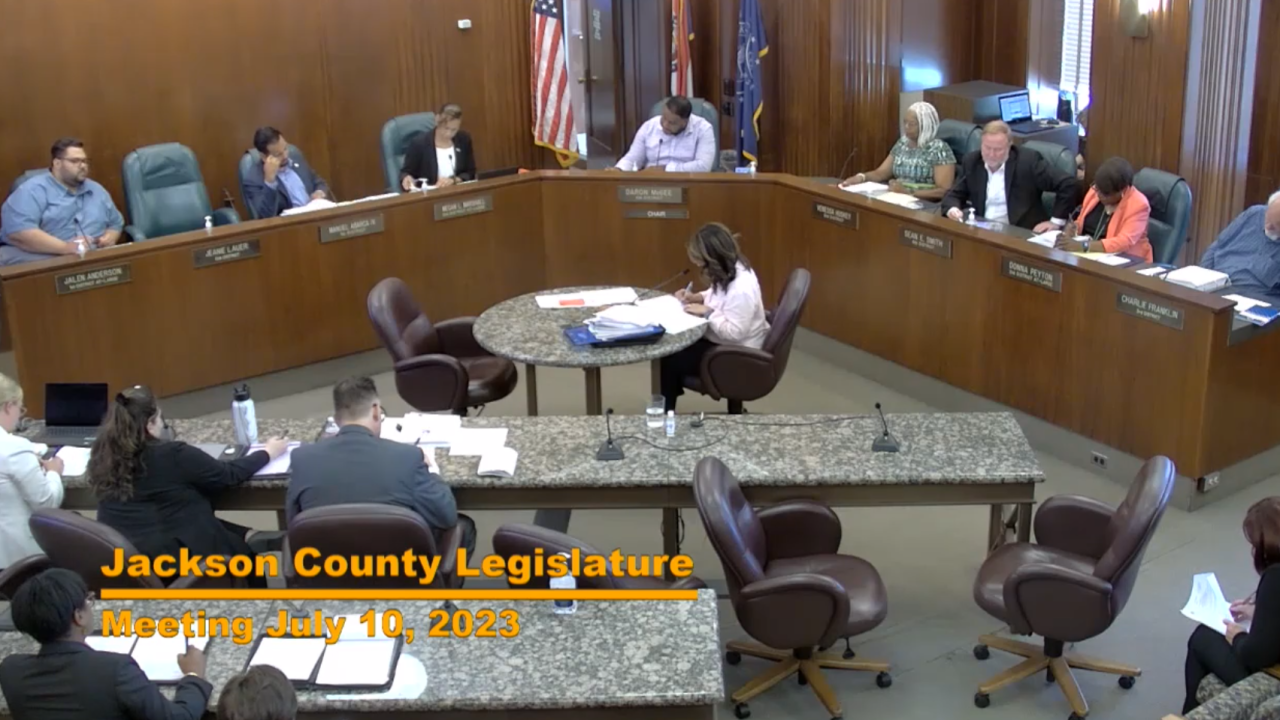

KANSAS CITY, Mo. – Amid rising anxieties over property tax assessments, Jackson County legislators Manny Abarca (District 1) and Sean Smith (District 6) held a press conference on Monday afternoon. The meeting aimed to spotlight taxpayers’ grievances and mobilize community participation in the upcoming public hearing, a critical component of the tax levy rate-setting procedure.

Allegations of Inflated Property Taxes

During the press conference, the legislators voiced their concerns regarding what they termed “illegally inflated county property taxes.” This issue has garnered significant attention following the recent intervention by the Missouri Tax Commission.

Last month, the Missouri Department of Revenue mandated that Jackson County reassess its 2023 property valuations by a reduction of 15% in most instances. However, some property owners have reported discrepancies, with assessment decreases reaching as high as 200%.

“We are dedicated to leveraging our legislative authority to mitigate the adverse effects that these tax increases have imposed on tens of thousands of taxpayers,” stated Sean Smith. “Our priority is to ensure that the tax burden remains fair and manageable for all residents.”

Key Ordinances Reviewed

The public hearing on Monday featured deliberations on four significant ordinances:

- Merchants’ and Manufacturers’ Inventory Replacement Levy

- County Community Mental Health Fund

- County Board of Services for the Developmentally Disabled Levy

- Jackson County, Missouri Tax Levies

Manny Abarca emphasized the importance of the levy-setting process, noting, “While it may seem routine, adjusting levy rates is one of the most effective ways we can influence the actual taxation rates. It’s imperative that we review our budgets meticulously and reallocate resources to alleviate the tax pressure on our constituents.”

Strategic Pause in Levy Rate Setting

In response to community feedback, Sean Smith revealed plans to temporarily suspend the levy rate-setting process for the current week. “Our objective is to gather comprehensive input from our constituents and, by next week, establish a fair levy rate ahead of the October 1 statutory deadline,” he explained.

Commitment to Fair Taxation

Both legislators reiterated their commitment to equitable taxation practices, assuring Jackson County residents that their voices would play a pivotal role in shaping future tax policies.

Official Response from County Executive’s Office

Upon reaching out for comments, a spokesperson from the County Executive’s office provided the following statement:

“Here is a link to the Ordinance, which outlines the state constitutional requirements and county laws governing the levy rate determination. As indicated, the County is proposing a reduction in the levy, consistent with the process employed by the Legislature to approve last year’s levy.”

Reliable Sources

Frequently Asked Questions (FAQ)

The Missouri Tax Commission ordered Jackson County to reassess 2023 property valuations to ensure they reflect accurate market values. This reassessment aims to correct discrepancies and ensure fair taxation.

Residents can attend the public hearing by visiting the Jackson County Legislature’s official website, where dates, times, and locations are announced. Participation can also be facilitated through virtual attendance options.

A significant decrease in property assessments can lead to substantial reductions in annual property taxes, easing the financial burden on homeowners and potentially increasing disposable income for other expenses.

The ordinances include the Merchants’ and Manufacturers’ Inventory Replacement Levy, County Community Mental Health Fund, County Board of Services for the Developmentally Disabled Levy, and the overall Jackson County Tax Levies.

The new levy rate is expected to be established by next week, ahead of the statutory deadline of October 1.

This report utilizes information from Jackson County’s official communications and the Missouri Department of Revenue to provide accurate and current details regarding the property tax reassessment and legislative actions.

For more information, visit the Jackson County Official Website or the Missouri Department of Revenue.

Jonathan Hartley is a highly regarded senior criminal lawyer with over 15 years of experience in the UK legal system. He began his career at a prestigious law firm in London, where he specialized in both defense and criminal law. Known for his ability to craft compelling defense strategies, Jonathan has successfully represented clients in high-profile cases and earned multiple awards for his contributions to the field of law.

In addition to his legal practice, Jonathan is also an accomplished legal writer, contributing articles to top legal blogs and online platforms. His work not only provides valuable insights into legal matters but also meets Google’s E-E-A-T standards by delivering accurate, reliable, and trustworthy information to readers. Committed to legal ethics and public welfare, Jonathan actively participates in discussions on law and justice while educating the public through his writing.